Key Summary

- Fallowfield offers the highest average rental yield in Manchester, boasting an impressive 11.56%.

- Manchester has witnessed significant property price growth, making it a prime location for potential investors.

- Location, future regeneration prospects, and tenant demand are all pivotal to determine the profitability of an investment.

What is Rental Yield?

Rental yield is a percentage figure that indicates the annual rental income as a proportion of the property’s value.

It’s a vital statistic for investors as it provides insight into the potential returns on an investment property, before factoring in any mortgage costs.

Essentially, a higher rental yield often suggests a better return on investment. Knowing your potential rental yield will help determine whether or not it is worth being a landlord in any particular area.

If you are considering becoming a landlord make sure you are up to speed with all legally required landlord responsibilities such as landlord/tenant deposit requirements and EPC certificates.

An Overview Of Manchester Rental Yield

Manchester, known for its industrial roots and rich history, has in recent times evolved into a property investment hotspot.

Over the past two decades, the city has witnessed a nearly 290% increase in property prices.

Moreover, with 37% of the city’s population aged between 18–34, there’s a robust demand for rental properties, particularly from young professionals and students.

The combination of cultural diversity, excellent transport links, and massive regeneration projects (such as MediaCityUK) make Manchester an ideal city for property investment.

What’s the Best Rental Yield in Manchester?

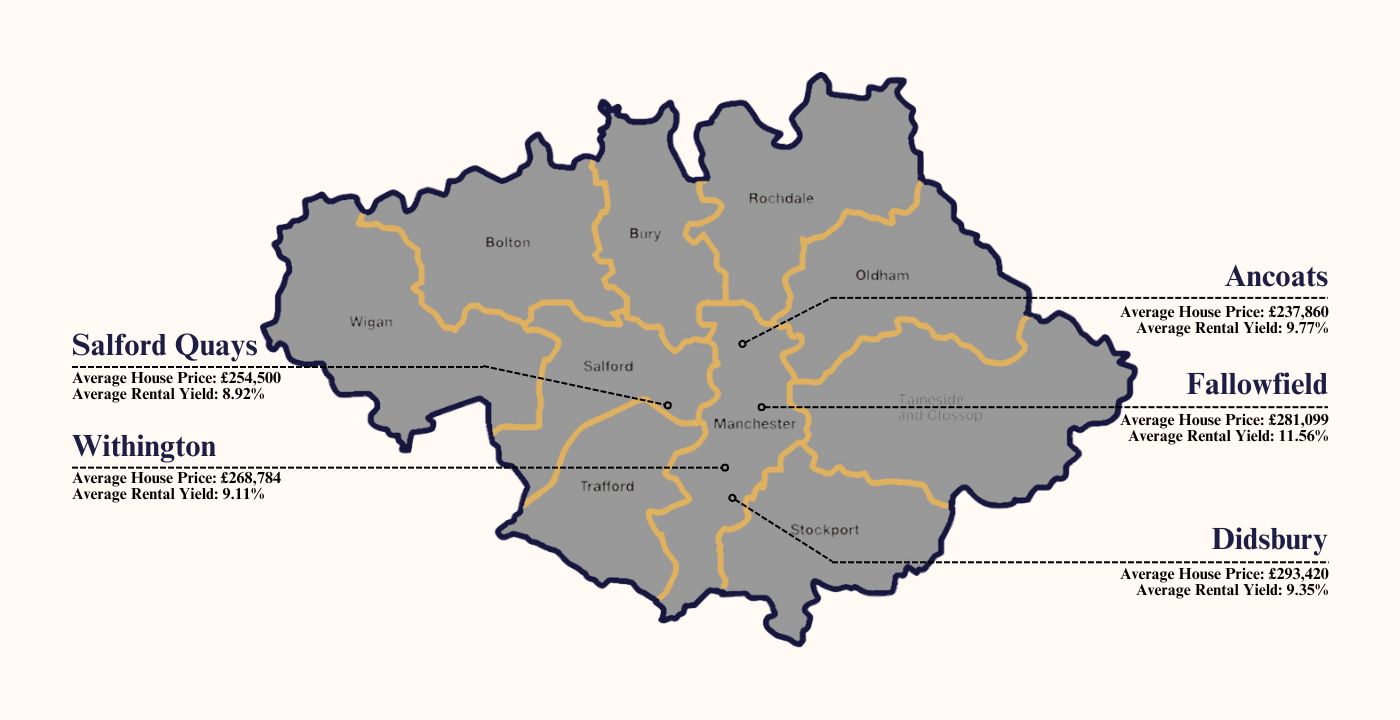

Fallowfield - Average House Price: £281,099 | Average Rental Yield: 11.56%

Based on the data for 2023, Fallowfield stands out with the highest rental yield in Manchester at 11.56%.

Its proximity to the University of Manchester and Manchester Metropolitan University, coupled with affordable property prices, has made it a hotspot for student accommodation.

Investors looking for a combination of capital appreciation and strong rental yields should consider Fallowfield as a top contender.

Exploring the Other Top Areas for Rental Yield in Manchester

Ancoats - Average House Price: £237,860 | Average Rental Yield: 9.77%

Ancoats, once known for its mills, has transformed into one of the city’s hippest districts, filled with independent eateries, craft beer bars, and modern apartments.

Its urban regeneration, proximity to the city centre, and appeal to young professionals have driven up rental demand. As a result, it provides a promising rental yield in Manchester.

Didsbury - Average House Price: £293,420 | Average Rental Yield: 9.35%

Didsbury, divided into East and West, is one of Manchester’s most affluent suburbs.

Its lively atmosphere, combined with excellent schools and transport links, has made it a favourite amongst families and professionals alike.

Its higher property prices are balanced by equally high rental prices, ensuring lucrative yields for investors.

Withington - Average House Price: £268,784 | Average Rental Yield: 9.11%

Adjacent to Fallowfield, Withington is another popular area among students, given its proximity to the city’s top universities.

Additionally, it attracts a considerable number of young professionals due to its local amenities and excellent transport links.

The area’s combination of student and professional renters ensures a stable and promising rental yield for Manchester investors.

Salford Quays - Average House Price: £254,500 | Average Rental Yield: 8.92%

Located near the city centre, Salford Quays is home to MediaCityUK, attracting a myriad of professionals in the media and digital sectors.

Its modern apartment complexes, entertainment venues, and cultural attractions, like the Lowry Theatre, make it an attractive location for renters.

The steady influx of professionals has ensured competitive rental prices and commendable yields for property investors.

Manchester Rental Yield by Postcode Area

| Postcode District | Avg Asking Price | Avg Rental Yield | Avg Sold £/sqft | Monthly Rental Turnover | Sales per month |

|---|---|---|---|---|---|

| M1 | £292,116.5 | 5.545% | £360.5 | 64.46% | 10 |

| M2 | £330,051 | 5.57% | £0 | 22.22% | 2 |

| M3 | £269,803 | 6.81% | £398 | 71.14% | 14 |

| M4 | £276,016.5 | 6.00% | £340 | 88.02% | 14 |

| M5 | £220,295 | 6.54% | £299.5 | 78.24% | 19 |

| M6 | £217,957 | 6.51% | £223.5 | 62.7% | 23 |

| M7 | £281,166 | 5.78% | £224.5 | 56.9% | 12 |

| M8 | £241,703.5 | 6.89% | £184 | 54.84% | 14 |

| M9 | £188,581.5 | 6.88% | £175.5 | 116.67% | 23 |

| M11 | £197,429.5 | 6.99% | £186.5 | 107.14% | 8 |

| M12 | £206,485 | 6.64% | £200.5 | 109.09% | 9 |

| M13 | £273,588 | 6.0% | £226.5 | 49.02% | 6 |

| M14 | £256,748.5 | 7.3% | £228.5 | 57.59% | 21 |

| M15 | £277,467.5 | 6.0% | £388.5 | 92.43% | 12 |

| M16 | £268,423 | 5.5% | £273 | 64.0% | 17 |

| M18 | £176,883.5 | 7.3% | £172.5 | 95.0% | 18 |

| M19 | £286,488.5 | 5.6% | £254.5 | 114.29% | 22 |

| M20 | £397,796.5 | 4.6% | £349 | 80.54% | 40 |

| M21 | £425,855.5 | 4.3% | £358 | 61.67% | 19 |

| M22 | £265,409 | 5.7% | £244 | 74.55% | 20 |

| M23 | £296,373.5 | 5.5% | £247 | 103.85% | 15 |

| M24 | £240,355.5 | 5.2% | £209 | 123.08% | 41 |

| M25 | £339,367 | 4.6% | £264.5 | 105.56% | 27 |

| M26 | £219,683.5 | 5.5% | £196.5 | 111.54% | 31 |

| M27 | £246,808.5 | 5.5% | £225.5 | 88.24% | 41 |

| M28 | £334,844 | 4.7% | £255.5 | 63.22% | 39 |

| M29 | £270,752 | 4.9% | £225 | 57.14% | 19 |

| M30 | £267,112.5 | 5.5% | £234 | 88.06% | 28 |

| M31 | £247,130.5 | 5.3% | £218 | 50.0% | 4 |

| M32 | £322,152 | 4.7% | £263 | 126.67% | 15 |

| M33 | £403,421.5 | 4.4% | £343 | 57.29% | 40 |

| M34 | £241,166 | 4.8% | £223 | 92.31% | 39 |

| M35 | £238,992.5 | 5.6% | £215 | 57.14% | 21 |

| M38 | £171,803.5 | 6.6% | £150.5 | 46.15% | 8 |

| M40 | £208,346.5 | 6.5% | £195 | 76.67% | 33 |

| M41 | £361,916.5 | 4.4% | £311 | 88.89% | 25 |

| M43 | £217,740 | 6.0% | £213 | 62.5% | 19 |

| M44 | £242,597.5 | 4.7% | £215 | 84.62% | 14 |

| M45 | £325,908 | 4.5% | £241 | 31.25% | 18 |

| M46 | £198,391.5 | 5.8% | £179 | 69.23% | 29 |

| M50 | £230,458 | 6.4% | £307 | 95.0% | 9 |

Frequently Asked Questions (FAQs)

Why is Manchester a good choice for property investment?

Manchester’s rapid economic growth, driven by sectors such as technology, finance, and media, combined with extensive regeneration projects and a young, growing population, make it a prime choice for property investment.

Its popularity has also increased in conjunction with the increased costs of property, rent, and living expenses in London in recent years.

How has Manchester's rental yield changed over the years?

Since 2003, Manchester property prices have increased by almost 290%, with rental yields reflecting this upward trend.

Neighbourhoods such as Ancoats have seen property prices increase by nearly 195% over the last 2 decades.

Which areas in Manchester are emerging as new investment hotspots?

Emerging areas with growing rental markets and strong potential rental yields include Castlefield, Piccadilly, Wythenshawe, Levenshulme, Droylsden, and Wigan.

Conclusion

Manchester’s robust economy, driven by urban regeneration, a young population, and the growth of sectors like technology and media, has cemented its position as a top destination for property investors.

With areas like Fallowfield offering stellar rental yields and other neighbourhoods like Ancoats seeing consistent capital appreciation, Manchester remains a cornerstone for those seeking solid returns in the UK’s property market in 2023.

If you are interested in finance or risk management for Manchester property investments get a free quote today.