As we move further into 2023, and continue with an economically challenging environment, landlords in Manchester will be keen to know what the property market holds for them.

Understanding market trends and property forecasts is key to making informed decisions about rental properties, and we’re here to help. So, keep reading to find out more!

Lacking time? Here’s our overview

- Manchester’s property market continues to grow with property prices increasing by almost 6% compared to last year.

- The current supply and demand issue means that there is a high rental demand that is creating higher yields- great news for investors!

- The booming economy and large student popularity are key benefits to the investment in Manchester.

- To ensure you make the most of your investment, keep on top of the key trends and use a property management company to oversee the day-to-day tasks.

Property Market Trends in Manchester

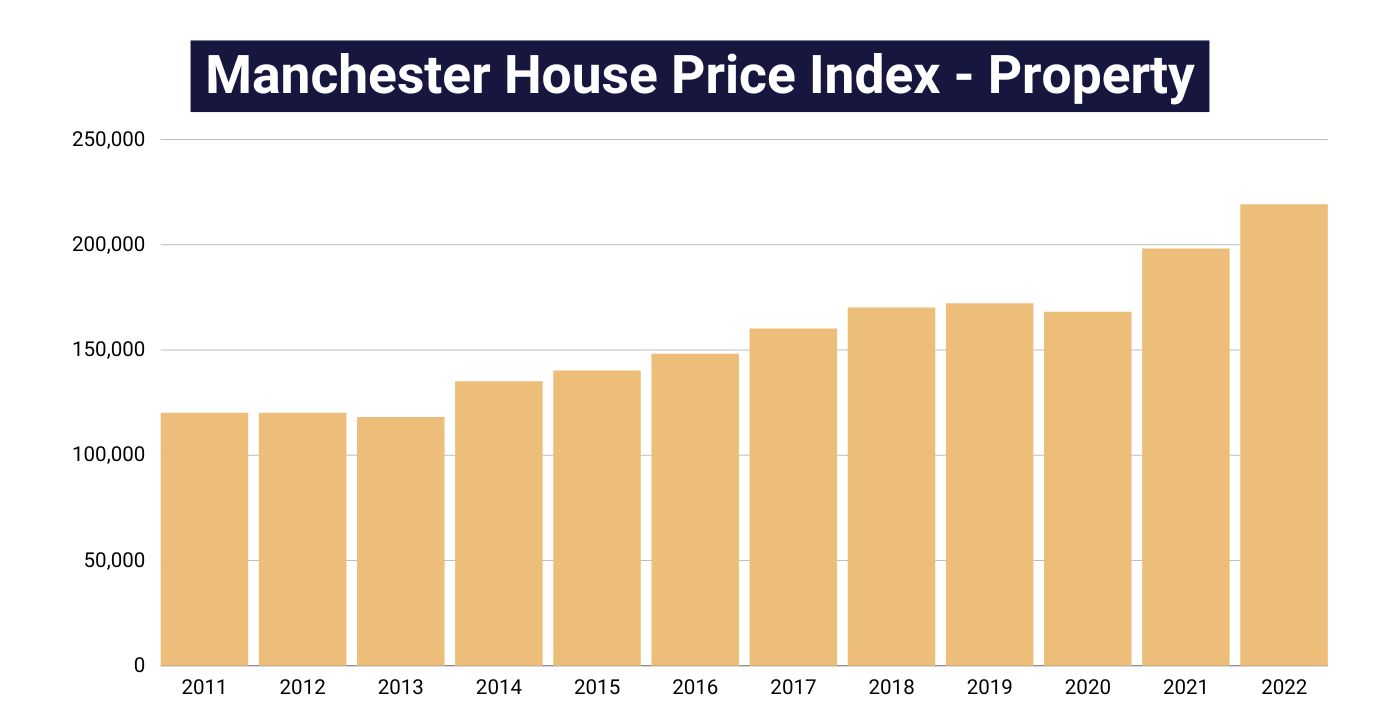

The Manchester property market has seen consistent growth over the past few years, and this trend is expected to continue in 2023. According to the latest data from Zoopla, the average property price in Manchester is £256,330 which is a 5.92% increase compared to the previous year.

Thanks to a thriving economy, property prices are still rising in Manchester. The city has seen significant investment in recent years in the creative and technology sectors which has further increased the demand for housing and, consequently, the property prices.

Demand for rental properties is also a trend expected to continue throughout 2023. This is as a result of various factors including a decline and shift in attitude towards home ownership and economic growth. This continued need for rental homes will push yields to higher levels, making it a hugely appealing market for landlords.

Manchester Property Market Forecast

Looking ahead to the rest of 2023, Manchester’s property market looks to remain strong with property prices forecasted to increase by up to 5% in 2023. This is slightly lower than the previous year’s growth rate but reflects the anticipated increase in interest rates, which will make it more of a challenge for buyers to enter the market.

If you compare average property prices from January 2022 with January 2023, there is an impressive increase of 9.8% which clearly demonstrates the strength of the market. Notably, apartments and flats are proving to be particularly popular, again, partly due to that strong rental market with the city centre and surrounding suburbs enjoying the most growth.

Although growth rates are predicted to be slightly slower, it is clear that Manchester remains an attractive option for property investment and the government’s commitment to investing in the Northern Powerhouse Rail project is expected to have an even further positive impact on the city’s property market.

Property Management Industry Analysis

The property management industry is an essential part of the rental property market and, as such, it is essential that landlords have a strong understanding of current market trends. In recent years, the industry has seen significant growth due to the increase in demand for rental properties.

Technology

One of the main trends in the property management industry is the use of technology. Property management software and apps have become increasingly popular, making it easier for landlords to manage their properties remotely. This trend is expected to continue in 2023, with more landlords adopting digital solutions to manage their rental properties.

Tenant Experience

Another trend in the property management industry is the increased focus on tenant experience. Landlords are recognising the importance of providing a positive rental experience for tenants, and property management companies are responding to this trend so expect to see more property management companies offering amenities such as on-site gyms, concierge services, and other perks to attract tenants.

Supply and Demand

As already mentioned, rental demand in Manchester continues to be high thanks to the vibrancy of this thriving city. This demand is partly driven by the city’s population, making the city centre and surrounding suburbs hugely popular, and has been steadily increasing in recent years, with no signs of a slow down imminent.

Here’s a table showing the number of rental properties over the years.

| Year | Number of Rental Properties |

|---|---|

| 2019 | 15,000 |

| 2020 | 13,500 |

| 2021 | 11,750 |

| 2022 | 10,150 |

| 2023 | 9,000 |

As you can see, despite this high demand for rental properties, the supply has not been able to keep up with a real shortage of places to rent in the city, which has resulted in higher rents and increased competition amongst tenants. The supply of rental properties in Manchester has been decreasing in recent years, with a 14% decline in the number of rental properties available in the city centre alone.

This supply-demand imbalance has created a favourable environment for landlords, as they can charge higher rents and enjoy a steady stream of tenants. In fact, according to research, rents have increased by as much as 38% in some parts of the city but it has also created challenges for tenants, who may struggle to find suitable and affordable rental properties in the city.

As the city continues to grow and attract more residents, the demand for rental properties is expected to remain high which, of course, presents an excellent opportunity for landlords who are looking to invest in the Manchester property market.

Benefits of Property Investment in Manchester

Investing in property in Manchester has become increasingly popular in recent years, and for a good reason. Asides from the high rental demand, which is keeping rental yields well above the national average at 5.5%, the city has experienced steady economic growth and is a student hub.

Here’s a table comparing the average property price in different areas around Manchester:

| Area | Average Property Price |

|---|---|

| City Centre | £312,450 |

| South Manchester | £274,820 |

| North Manchester | £189,350 |

| East Manchester | £161,550 |

| West Manchester | £230,100 |

Manchester is a city with a diverse and robust economy, with strong growth in various sectors such as technology, media, and healthcare creating a stable investment environment, with plenty of opportunities for long-term growth and stability.

The city is also an attractive destination for students, with several universities and a large student population, creating a high demand for student accommodation that makes it an excellent market for landlords looking to invest in buy-to-let properties.

Managing Rental Properties

If you are a landlord in Manchester, you will understand the importance of keeping up to date with the latest trends and developments in the property management industry.

Maintenance and Repairs

One of the key areas to focus on is maintenance and repairs. In order to attract and retain tenants, it is essential to ensure that your properties are well-maintained and that any issues are addressed promptly.

Tenant Screening

Enhance your property’s security by strategically deploying surveillance cameras, covering key areas such as entrances and parking spaces. Select a reliable video storage and monitoring system, with cloud storage so that you can access the footage remotely. It is also worth choosing a system that has night vision capabilities for optimal surveillance

Effective Property Management

The Manchester property market is forecasted to continue to grow in 2023, with demand for rental properties showing no signs of a slow down.

Landlords should focus on providing well-maintained properties and building positive relationships with tenants to attract and retain tenants. If you are looking to outsource your property management tasks, contact us today- we’ll discuss how we can help you to manage your investments more effectively.